The tax you pay when you sell an investment property is known as Capital Gains Tax (CGT).

This needs to be declared in the year of sale in your tax return.

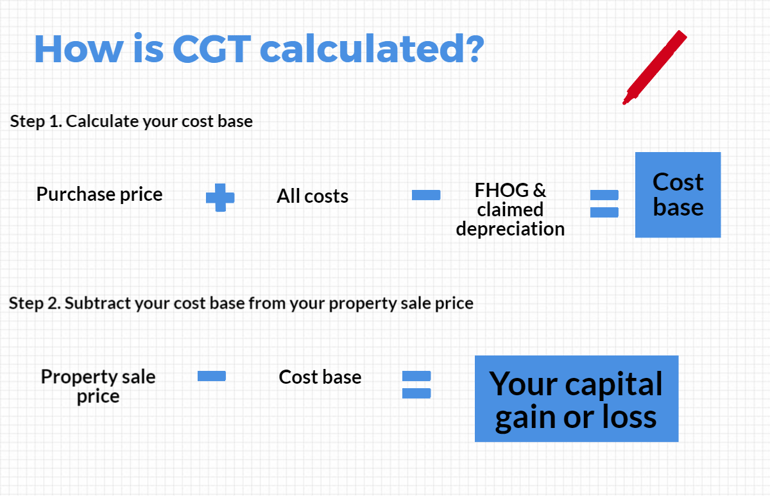

Capital Gain is calculated by taking the capital proceeds; which include how much the property was sold for, less the cost base of your property.

The cost base includes the amounts you paid for the property, plus incidental costs, less the building depreciation claimed along the way.

If the property you own was purchased before the 1990’s or is not residential, the cost base is slightly changed.

Also, there are different rules for calculating CGT for trusts, super funds and companies.

RealRenta is disrupting the Real Estate industry with our Self Management platform .

RealRenta is for Smart Investors, who realise that they are no longer bound to traditional property management and the associated high fees

Use RealRenta for Free for up to 2 months: https://app.realrenta.com/Signup.aspx