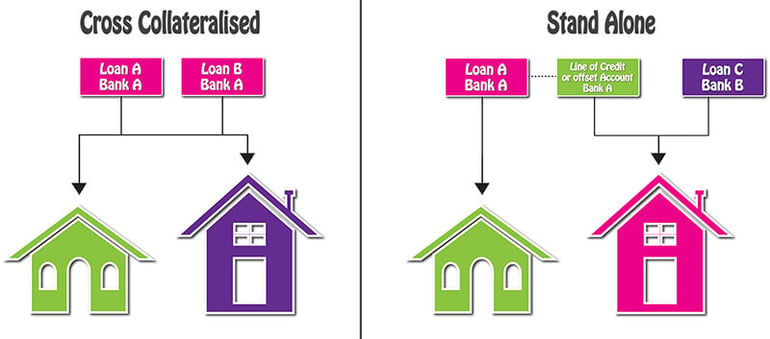

Cross- Collaterisation is where more than one property is used as security for a mortgage.

It is a great strategy for growing your portfolio, if you don’t plan to sell any of your properties for at least 10 years, or you don’t plan on buying any more investments in the near future.

One of the biggest advantages of this strategy is that you can access a lower owner occupied interest rate on your whole portfolio, as opposed to a high investment loan rate, because some lenders, will allow you to use your owner occupied property in the cross-securitisation.

In addition, because you are using equity to purchase an investment property at 100% of the value, your purchase is potentially 100% tax deductible.

One of the main disadvantages is that if you can’t pay your loan, the bank can decide where the proceeds of a sale are allocated on a cross-securitised mortgage.

Potentially, this could mean that the bank can force you to sell your principal residence, rather than your investment property.

Cross-collaterisation should not be entered into lightly and using multiple lenders may be a better long term investment strategy.

Join the growing number of smart Aussie Property Investors by cutting your costs using RealRenta to automatically manage your residential investment property.

You will never use a Property Manager again : https://app.realrenta.com/Signup.aspx