Smart Investors recognise that they can't just rely on good luck AND know that they need to consider their goals and act...

Blogs

Whilst you live in your home you are free from tax consequences and if you sell it, you should get capital gains exemption.

If an investment property is transferred to you in a will that was bought after the 19 September 1985, you will inherit the cost...

Rentvesting is a popular strategy with first home buyers who want to get into the property market but don’t want to give up their...

Banks consider heritage listed properties to be a higher risk than normal properties, as they do not appeal to the general market.

One of the biggest benefits of negative gearing is of course the tax refund.

Before deciding on your preferred strategy, it pays to understand the fundamental principles that underpin cash flow and growth...

Generally speaking, a good long term strategy for investing in property is balance.

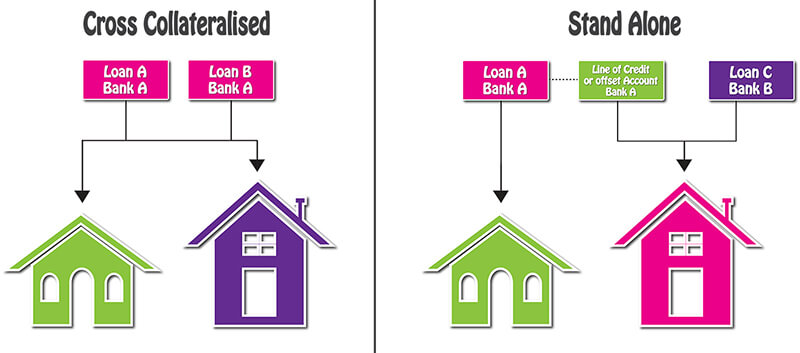

Cross- Collaterisation is where more than one property is used as security for a mortgage.